TUSCALOOSA, Ala. — In honor of Veteran’s Day, UA’s Center for Business and Economic Research compiled some interesting statistics about veterans in Alabama. Veterans make up a significant portion of Alabama’s population, with about 9.8 percent of Alabama’s population identifying as a veteran, according to the U.S. Census Bureau’s 2011‐2015 American Community Survey estimates. Data from the U.S. Department of Veteran Affairs estimates about 370,000 veterans live in Alabama as of September 30, 2017. By examining the demographic characteristics, educational attainment, and entrepreneurship of veterans in Alabama, we can appreciate the diversity of veterans and the impact they have on their local communities.

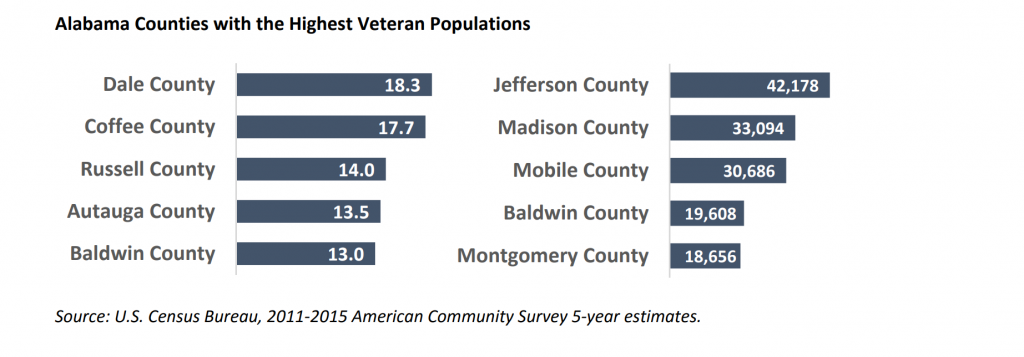

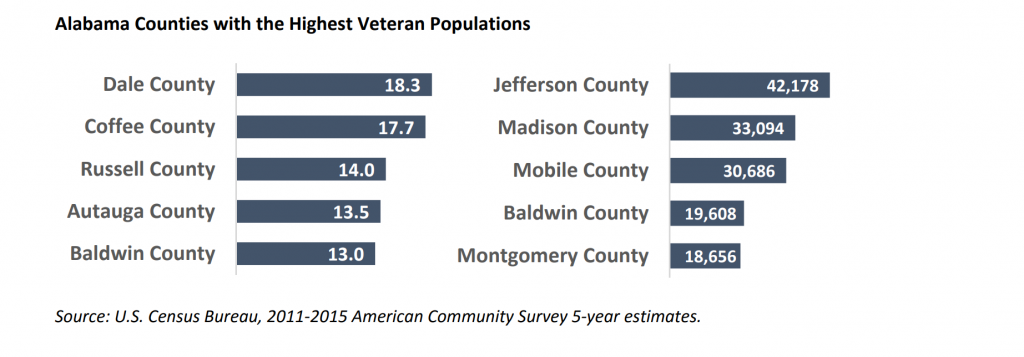

Alabama veterans live throughout the state, but there are several counties that seem to be favorites for those who served in the armed forces. According to the U.S. Census Bureau’s 2011‐2015 American community Survey (ACS) estimates, Dale County has the highest percentage population of veterans at 18.3 percent. Coffee County follows closely, with 17.7 percent of its population identifying as veterans. Russell, Autauga, and Baldwin counties all have veteran populations larger than 12.0 percent of their total population.

Looking at the number of veterans living in a county, we see many veterans living in the more populated counties. According to the same ACS data set, Jefferson County has the largest population of veterans in the state, with about 42,000 veterans calling the county their home. Madison County also has a significant population of veterans (33,094), as does Mobile County (30,686). Baldwin and Montgomery counties both have large veteran populations at 19,608 and 18,656, respectively.

Demographic Characteristics

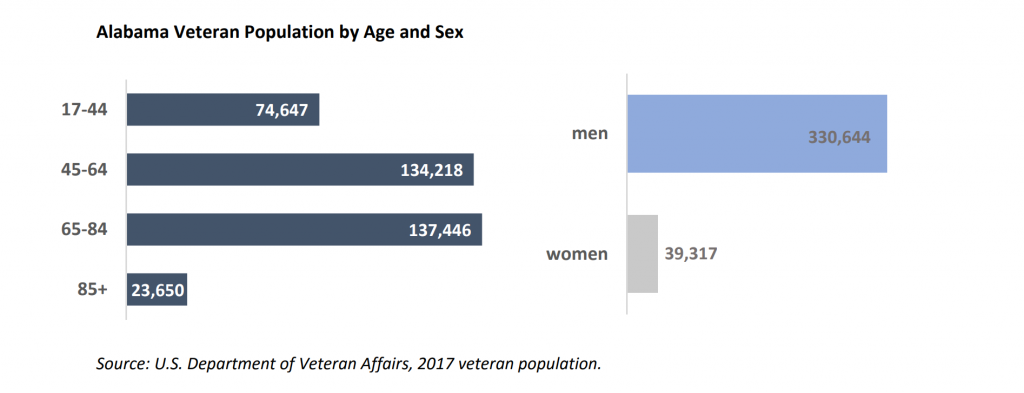

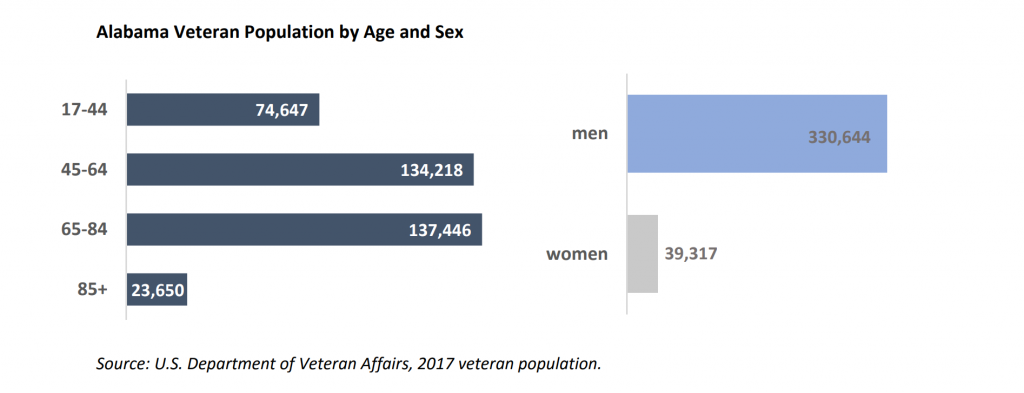

About a fifth of Alabama veteran population in 2017 are 17 to 44 years old, according to the U.S. Department of Veteran Affairs. More than a third or 36.3 percent are 45 to 64 years old, 37.2 percent are 65 to 84 years old, and 6.4 percent are 85 and over. Most of veteran population in the state are men (89.4 percent) while 10.6 percent are women.

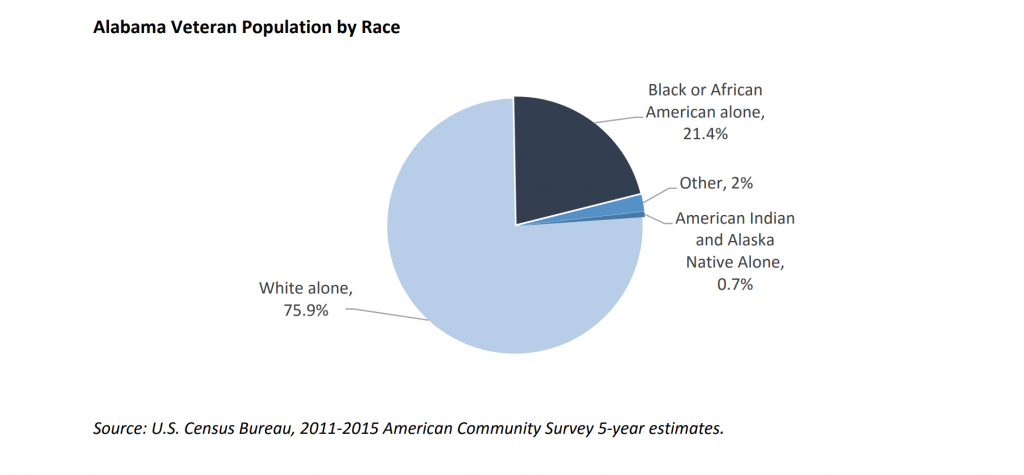

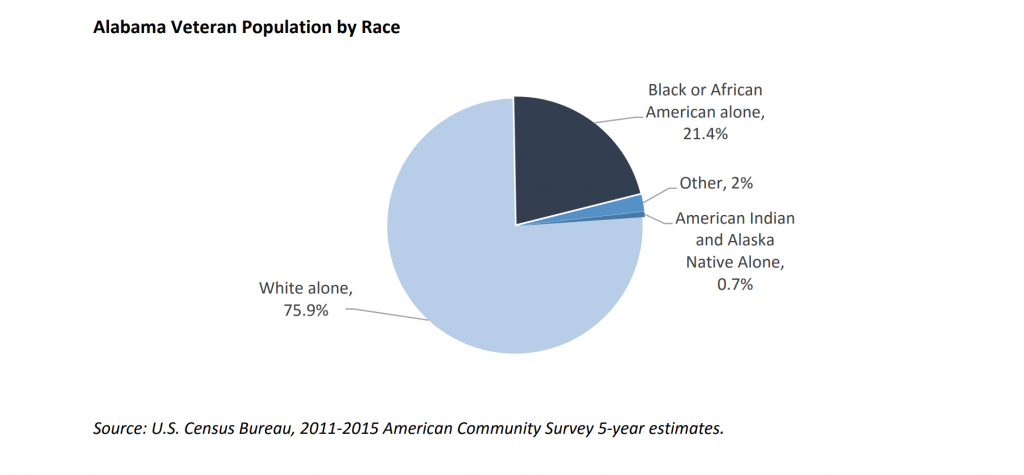

According to the U.S. Census Bureau’s ACS data, 21.4 percent of Alabama veterans identify as Black or African American; 0.7 percent identify as American Indian or Alaska Native alone; and a 75.9 percent majority of veterans living in Alabama identify as White alone. Additionally, 1.5 percent of Alabama veterans identify as Hispanic or Latino of any race.

Educational Attainment

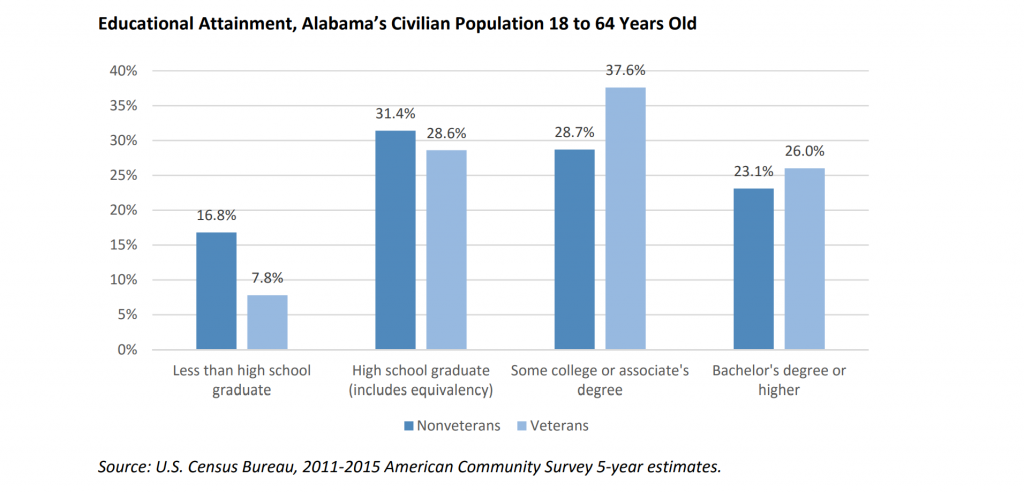

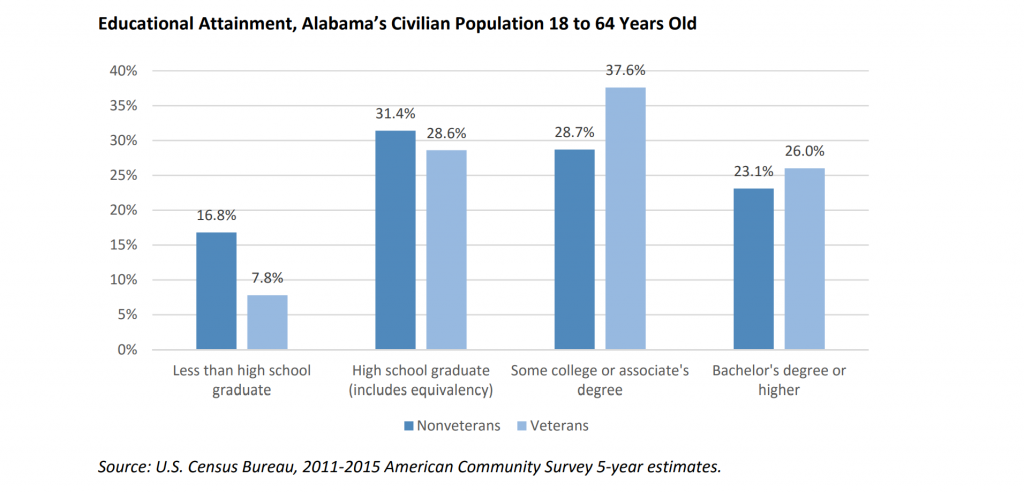

In Alabama, veterans tend to be more educated than nonveterans. Using estimates from the U.S. Census Bureau, you can see that a greater percentage of veterans than Alabama’s nonveteran population have at least a bachelor’s degree, and a larger portion of the veteran community has some college or associate’s degree than the nonveteran population. Additionally, a smaller percentage of veterans have less than a high school graduate’s level of education than the nonveteran population.

Entrepreneurship

Entrepreneurship

According to the most recent U.S. Census Bureau’s Annual Survey of Entrepreneurs (2015), among 66,691 Alabama firms, 9.6 percent or 6,425 were veteran‐owned and 3.3 percent or 2,201 firms were equally veteran‐/nonveteran‐owned. Veteran‐owned firms employed 68,669 people and had an annual payroll of almost $2.5 billion. Firms that were equally veteran‐ and nonveteran‐owned employed 20,946 people and had an annual payroll of $562.2 million.

Firms in educational services had the largest share of veteran‐owned firms: 16.4 percent or 117 out of 713 firms. The largest share of equally veteran‐/nonveteran‐owned firms was in mining, quarrying, and oil and gas extraction sector, with 14.3 percent or 17 out of 119 firms. Retail trade industry had the largest number of veteran‐owned firms: 1,103 companies. The largest number of equally veteran‐ /nonveteran‐owned firms was also in retail trade, with 362 companies.

More data on veteran population are available for all Alabama counties from the Census Bureau’s 2011‐ 2015 American Community Survey.

Contact: Viktoria Riiman, Socioeconomic Analyst, Culverhouse College of Commerce, Center for Business and Economic Research (CBER), 205‐348‐3757, vriiman@cba.ua.edu; Susannah Robichaux, Socioeconomic Analyst, Culverhouse College of Commerce, CBER, 205‐348‐3781, scrobichaux@cba.ua.edu