TUSCALOOSA, Ala. – Two snapshots of the state’s economy earlier this summer show recovery from the pandemic recession of 2020 exceeding expectations, with business leaders confident things were getting even better, according to research from The University of Alabama.

It’s unknown whether the rise of the Delta variant of the coronavirus that causes COVID-19 will dampen the economy, but, if it does, nothing short of another lockdown could stunt the recovery, said Ahmad Ijaz, executive director of the UA Center for Business and Economic Research.

“We will most likely see 5.0 to 5.5 percent growth for this year, and perhaps next year too, on the condition that we don’t shut down the economy again,” Ijaz said. “Another shut down will most likely have a much more devastating impact on the economy.”

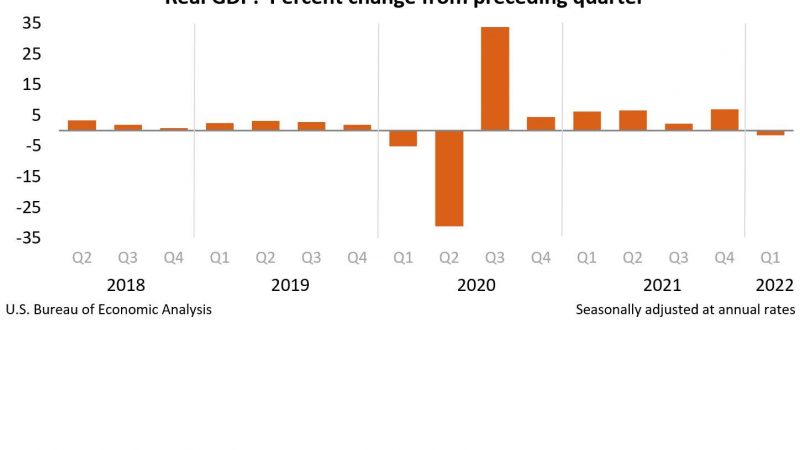

CBER released its quarterly economic forecast, Alabama Business, today which showed the state’s economy grew 6.8% in the first quarter of 2021, which followed a strong half of 2020 after plummeting economic activity the first half of last year.

The forecasted 5.5% economic growth for 2021 will make up the 2.7% drop in economic activity in 2020.

The state’s economy has continued to beat growth forecasts as business sectors come back at different speeds because of supply constraints and loose monetary policy fueled business and consumer spending, Ijaz said.

“At the start of the year, everybody was predicting that the economy would get back to its normal course after a huge jump in growth in third and fourth quarters of 2020, but as the year went along the economic growth just kept on accelerating,” he said.

The state gained 13,200 jobs in June over the previous three months. From June 2020 to June 2021, the state gained 89,200 jobs with a seasonally adjusted unemployment rate this June of 3.3 percent, down from the 7.7 percent unemployment rate in June 2020, according to the study.

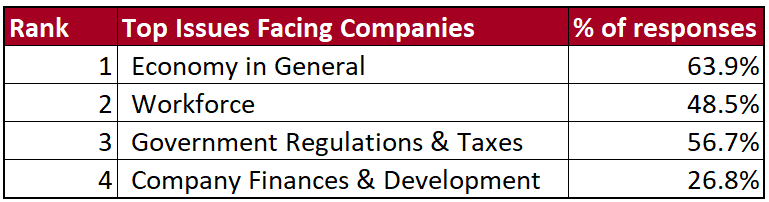

Also, CBER released its latest quarterly survey of local business leaders. Taken in the first half of June, it showed historical confidence about the direction of Alabama’s economy. The Alabama Business Confidence Index was 67, up nearly three points from the spring survey.

It’s the most confidence business leaders have had in forecasting economic growth since the third quarter of 2004, according to CBER data. Plus, this is the third consecutive quarter all the industry-level ABCIs have been positive, indicating sustained expectations for economic expansion across all industries in Alabama.

An index over 50 indicates a positive forecast compared to the previous quarter, and the higher the number, the more confident the forecast. The statewide and national forecasts, along with industry-specific components like sales, profits, hiring and capital expenditures comprise the six indexes that combine to make the ABCI total.

For those participating in the survey, more than three-fourths forecasted a better economic outlook for Alabama in the third quarter of the year, and 70 percent expected sales to increase compared to the second quarter of 2021.

“Alabama business leaders were feeling really good in June,” said Susannah Robichaux, socioeconomic analyst for CBER. “Many businesses throughout the state experienced some contraction and uncertainty due to COVID, and these latest ABCI results tell us that folks were really anticipating a recovery and feeling confident in their forecasts for growth. Now, some of that is up in the air due to the Delta variant making such a strong showing.”

The breakdown of all the industry forecasts by sector can be seen in the statewide ABCI report on CBER’s website.

In addition to the statewide ABCI report, CBER also collects ABCI data to write individual reports for Alabama’s five major metro areas. These metro reports offer insight into the forecasts for each specific region.

Original Source: https://news.ua.edu/2021/08/states-economic-recovery-booming-just-before-covid-19-resurgence/

The University of Alabama, part of The University of Alabama System, is the state’s flagship university. UA shapes a better world through its teaching, research and service. With a global reputation for excellence, UA provides an inclusive, forward-thinking environment and nearly 200 degree programs on a beautiful, student-centered campus. A leader in cutting-edge research, UA advances discovery, creative inquiry and knowledge through more than 30 research centers. As the state’s largest higher education institution, UA drives economic growth in Alabama and beyond.

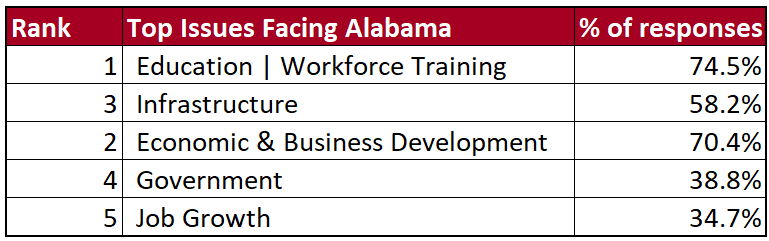

Alabama business leaders have voted education and workforce training as the state’s primary issues for the last five years. In the 2020 survey, 74.5 percent of panelists reported concerns about the state of the education and workforce training system, and 18 percent of those panelists provided specific comments, which included concerns about the lack of funding for education, the shortage of qualified workers, and a desire for more short-term training opportunities for all fields. Panelists ranked economic and business development as a close second at 70.4 percent, and 20.0 percent shared worries about the uncertainty related to COVID-19 and the importance of diversifying the state economy.

Alabama business leaders have voted education and workforce training as the state’s primary issues for the last five years. In the 2020 survey, 74.5 percent of panelists reported concerns about the state of the education and workforce training system, and 18 percent of those panelists provided specific comments, which included concerns about the lack of funding for education, the shortage of qualified workers, and a desire for more short-term training opportunities for all fields. Panelists ranked economic and business development as a close second at 70.4 percent, and 20.0 percent shared worries about the uncertainty related to COVID-19 and the importance of diversifying the state economy.