TUSCALOOSA, Ala. – State business leaders continue to be concerned about the national economy, dampening their financial outlook, according to the latest quarterly survey by The University of Alabama.

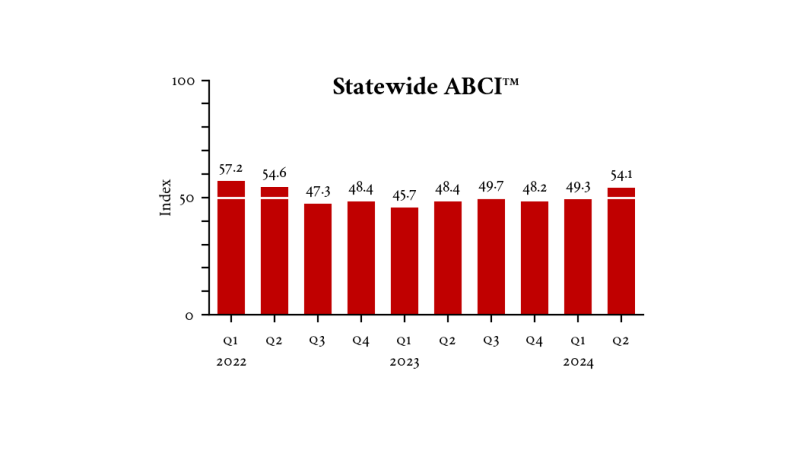

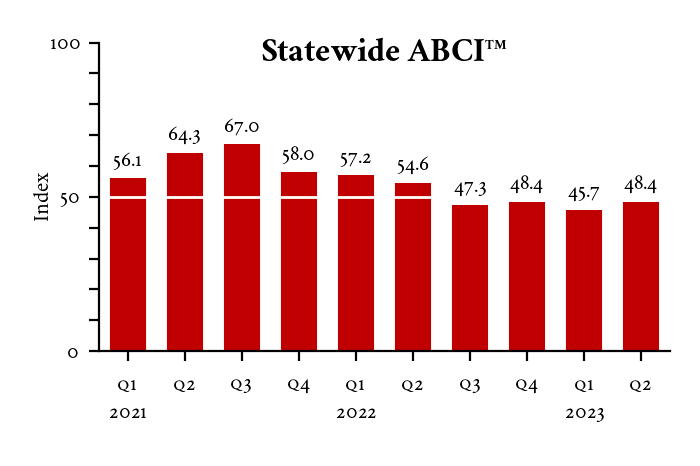

The UA Center for Business and Economic Research’s latest Alabama Business Confidence Index, taken in early September, decreased slightly, indicating expectations for a mild drop-off from last quarter’s economic performance.

The drop in confidence comes after the last survey found signs state business were reversing their negative outlook.

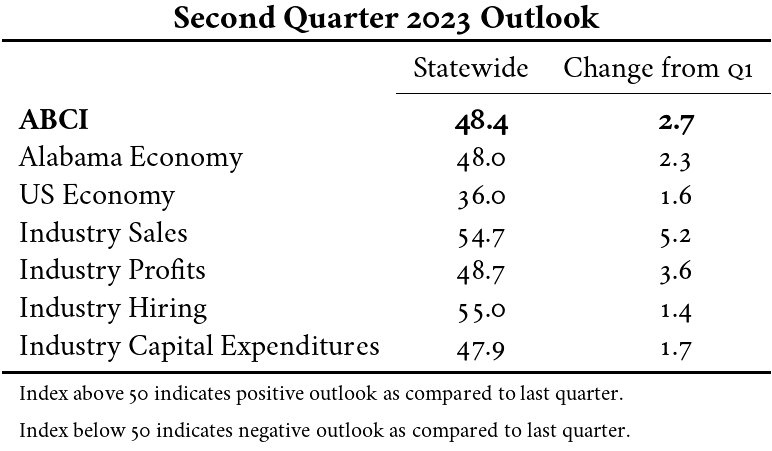

“The outlook for the U.S. economy remained strongly contractionary,” said Susannah Robichaux, socioeconomic analyst for CBER. “This index has been negative for the past eight quarters and the lowest component index for the past nine quarters, indicating sustained expectations for worse national economic conditions.”

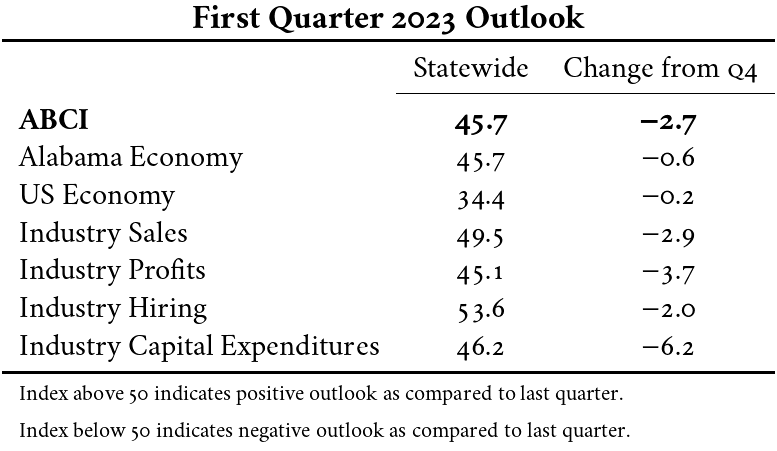

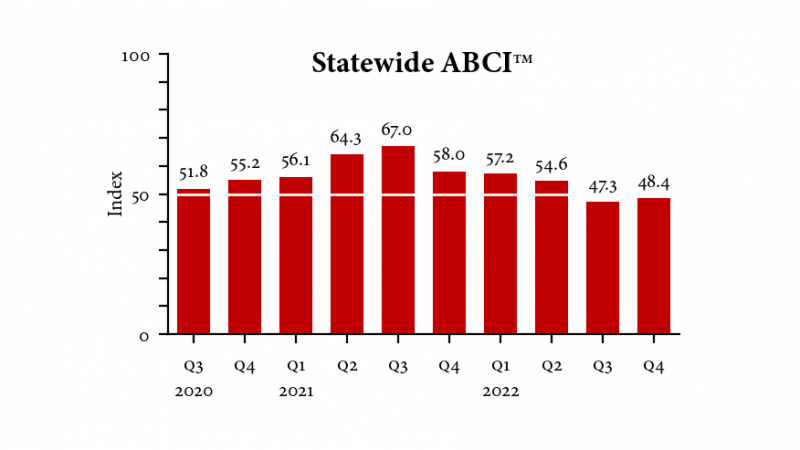

The ABCI for the fourth quarter of 2023 is 48.2, which is slightly below the third quarter’s neutral index but still a better outlook than the post-pandemic low of 45.7 in the first quarter of this year. An index over 50 indicates an expansionary forecast compared to the previous quarter, and the closer the number is to 100, the more confident the forecast.

ABCI is gathered from a broad group of business executives across the state with six key indicators and a composite index. The statewide and national forecasts, along with industry-specific components like sales, profits, hiring and capital expenditures comprise the six indexes that combine to make the ABCI total.

Lingering concern over a possible economic recession could be why business leaders remain negative on the national economy. The rising interest rates by the Federal Reserve may finally start to slow the economy down now that business and personal savings built up during the pandemic are depleted, said Ahmad Ijaz, CBER executive director.

“Alabama’s economy is still doing relatively well, one reason businesses are more optimistic about the state’s economy than they are about the national economy,” he said.

CBER forecasts the state’s economy to grow 1.5% this year, about the same as in 2022 with both employment and state tax collections growing more slowly than last year.

This quarter, five of the nine industry groupings had an index above 50 showing a positive outlook for their own industry’s sales, profits, hiring and capital expenditures. The industry grouping with the highest and largest increase in confidence includes panelists in transportation, information and utilities.

Only three industries are forecasting a decrease in their sales compared to the previous quarter: wholesale trade, retail trade, and manufacturing.

Of the five metro areas in the state tracked in the survey, business leaders in Montgomery and Tuscaloosa have mildly positive outlooks for their local economies while the rest had negative outlooks.

The breakdown of all the industry forecasts by sector can be seen in the statewide ABCI report on CBER’s website.

The University of Alabama, part of The University of Alabama System, is the state’s flagship university. UA shapes a better world through its teaching, research and service. With a global reputation for excellence, UA provides an inclusive, forward-thinking environment and nearly 200 degree programs on a beautiful, student-centered campus. A leader in cutting-edge research, UA advances discovery, creative inquiry and knowledge through more than 30 research centers. As the state’s largest higher education institution, UA drives economic growth in Alabama and beyond.

Contact

Adam Jones, UA Strategic Communications, 205-348-4328, adam.jones@ua.edu

Source

Susannah Robichaux, socioeconomic analyst for CBER, scrobichaux@cba.ua.edu

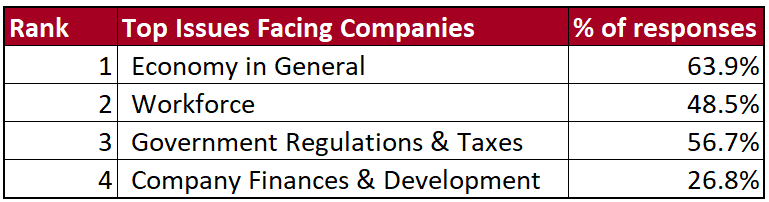

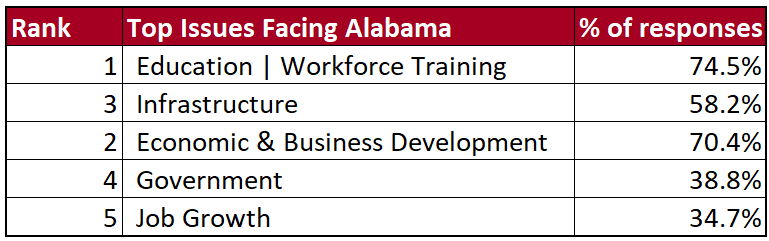

Alabama business leaders have voted education and workforce training as the state’s primary issues for the last five years. In the 2020 survey, 74.5 percent of panelists reported concerns about the state of the education and workforce training system, and 18 percent of those panelists provided specific comments, which included concerns about the lack of funding for education, the shortage of qualified workers, and a desire for more short-term training opportunities for all fields. Panelists ranked economic and business development as a close second at 70.4 percent, and 20.0 percent shared worries about the uncertainty related to COVID-19 and the importance of diversifying the state economy.

Alabama business leaders have voted education and workforce training as the state’s primary issues for the last five years. In the 2020 survey, 74.5 percent of panelists reported concerns about the state of the education and workforce training system, and 18 percent of those panelists provided specific comments, which included concerns about the lack of funding for education, the shortage of qualified workers, and a desire for more short-term training opportunities for all fields. Panelists ranked economic and business development as a close second at 70.4 percent, and 20.0 percent shared worries about the uncertainty related to COVID-19 and the importance of diversifying the state economy.