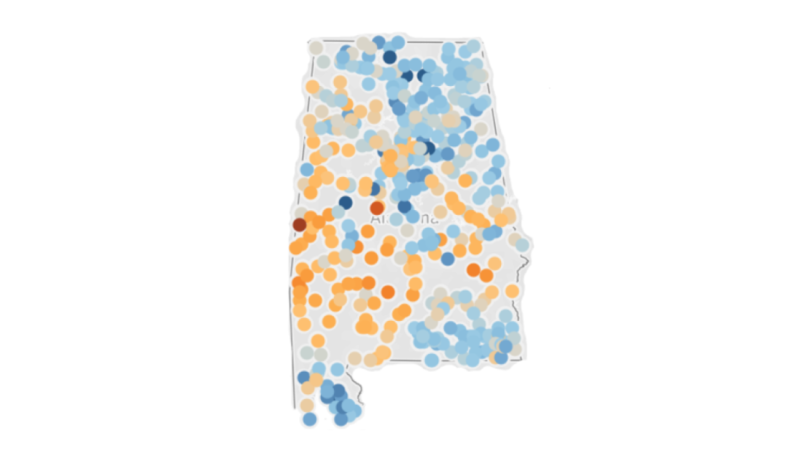

From 2023 to 2024, 41 of Alabama’s 67 counties experienced population growth according to new estimates released on March 13, 2025 from the U.S. Census Bureau’s Population Estimates Program.

Population can grow in two ways: through a natural increase, which is when births outnumber deaths in an area, or through positive net migration, which is when more people move into an area than out of it.

Overall, the state’s population grew by 40,026 people from July 1, 2023 to July 1, 2024. During that period, Alabama experienced a natural decrease: deaths outnumbered births in the state by 1,732. However, that was significantly offset by positive net migration: 41,791 more people moved into Alabama than out of it. Just over 62 percent (26,028) of those people moved to Alabama from somewhere else in the US, while the remaining 38 percent (15,763) moved from somewhere internationally.[1]

Population Growth by County from 2023 to 2024

Breaking it down into smaller geographies, the population in 34 of Alabama’s 67 counties grew by more than 100 people from July 1, 2023 to July 1, 2024; 20 counties either gained or lost fewer than 100 people; and 14 counties saw population decreases of more than 100 people in from 2023 to 2024.

Six counties had significantly more in-migration than the rest of the counties, with a net migration higher than 1,400 people: Madison, Baldwin, Limestone, Shelby, Tuscaloosa, and St. Clair. Those six counties also had the highest total population growth by raw numbers (see Table 1).

Madison County and Baldwin County had the highest population growth by raw numbers, with their respective populations increasing by 9,464 and 7,501 people over the year. Madison County had 793 more births than deaths, adding to their population growth, but Baldwin County actually had a negative natural change, with 150 more deaths than births from July 1, 2023 to July, 1 2024.

Table 1: Six High-Growth Counties and Alabama Population

Components of Change from 2023 to 2024

|

Total Population Change

|

Natural Change

(births minus deaths) |

Total Net Migration |

| Alabama |

40,026 |

-1,732 |

41,791 |

| Madison County |

9,464 |

793 |

8,680 |

| Baldwin County |

7,501 |

-150 |

7,645 |

| Limestone County |

4,139 |

175 |

3,979 |

| Shelby County |

3,576 |

457 |

3,103 |

| Tuscaloosa County |

2,376 |

703 |

1,673 |

| St. Clair County |

2,008 |

563 |

1,426 |

View detailed table here that includes all 67 counties as well as detailed breakdowns of the components of change.

Source: U.S. Census Bureau, Population Division

Population Growth by MSA from 2023 to 2024

Much of the state’s growth from 2023 to 2024 occurred in counties that are part of Alabama’s twelve metropolitan statistical areas (MSAs). The Census Bureau defines the general concept of a metropolitan as that of an urban core area of 50,000 inhabitants or more, together with adjacent counties that have a high degree of economic and social integration with that core.

All of Alabama’s twelve MSAs experienced some population growth from 2023 to 2024, though the scale of that growth ranged from just a few people to several thousands (see Table 2). The Huntsville MSA, which includes Madison and Limestone counties, had the highest population growth, while the Birmingham and Daphne-Fairhope-Foley MSAs also saw significant growth of over 6,000 people.

All of the MSAs had positive net migration while only half experienced natural growth. Birmingham had the third highest net migration of the MSAs and was notably the only one to have higher international net migration (3,751) than domestic (2,205).

Table 2: Alabama MSA Population Components of Change from 2023 to 2024

| Metropolitan Statistical Area |

Total Population Change |

Natural Change

(births minus deaths) |

Total Net Migration |

| Anniston-Oxford |

24 |

-325 |

350 |

| Auburn-Opelika |

3,388 |

340 |

3,031 |

| Birmingham |

6,382 |

441 |

5,956 |

| Daphne-Fairhope-Foley |

7,501 |

-150 |

7,645 |

| Decatur |

691 |

-228 |

916 |

| Dothan |

1,286 |

-211 |

1,496 |

| Florence-Muscle Shoals |

1,038 |

-442 |

1,486 |

| Gadsden |

33 |

-427 |

460 |

| Huntsville |

13,603 |

968 |

12,659 |

| Mobile |

594 |

355 |

246 |

| Montgomery |

1,385 |

688 |

697 |

| Tuscaloosa |

1,788 |

436 |

1,334 |

View detailed table here that includes detailed breakdowns of the components of change for the MSAs as well as Alabama’s 12 micropolitan statistical areas.

Source: U.S. Census Bureau, Population Division

All of the latest population estimates for Alabama as well as its counties, MSAs, cities, and towns can be found in easy-to-use spreadsheets on CBER’s Alabama Demographics page. These data are provided as a free service from the University of Alabama’s Center for Business and Economic Research as part of their role as the lead agency for the Alabama State Data Center (ASDC) and for the Federal State Cooperative for Population Estimates (FSCPE). If you have any questions about this or other local data, please feel free to reach out to CBER’s socioeconomic team: Dr. Nyesha Black (ncblack@ua.edu) or Susannah Robichaux (scrobichaux@ua.edu).

[1] Net international migration for the United States includes the international migration of both U.S.-born and non-U.S.-born populations. Specifically, it includes: (a) the net international migration of the non-U.S. born, (b) the net migration of U.S. born to and from the United States, (c) the net migration between the United States and Puerto Rico, and (d) the net movement of the Armed Forces population between the United States and overseas.