State Business Leaders Expecting Economic Growth

- April 9th, 2021

TUSCALOOSA, Ala. – In the latest quarterly survey by researchers at The University of Alabama, business leaders in the state are feeling more encouraged about the economy than they have since the global pandemic began.

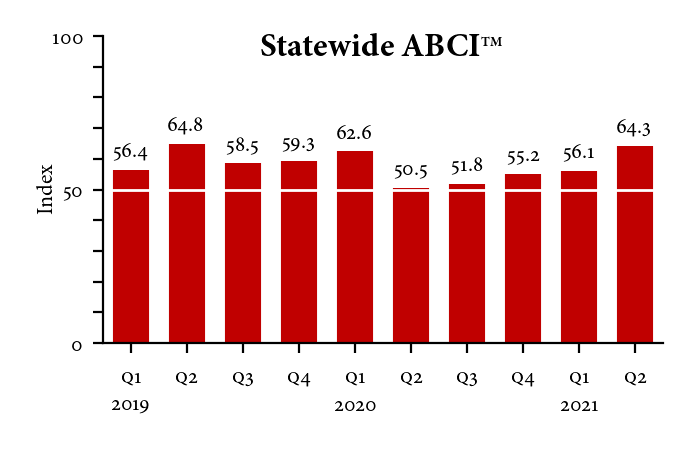

The UA Center for Business and Economic Research’s most recent Alabama Business Confidence Index shows that local business leaders have strong expectations for economic growth in the second quarter of 2021. The statewide business confidence index was 64.3, up more than eight points from the survey of the first quarter of 2021.

It’s one of the highest indexes ever and the most confident business leaders have been in the economy since the second quarter of 2019. It continues a steady recovery of confidence since the early days of the pandemic in the second quarter of 2020, when the ABCI decreased to 50.5 and business leaders were uncertain of what the coming quarter would hold for the economy.

An index over 50 indicates a positive forecast compared to the previous quarter, and the higher the number, the more confident the forecast. The statewide and national forecasts, along with industry-specific components like sales, profits, hiring and capital expenditures comprise the six indexes that combine to make the ABCI total.

“This outlook suggests that business leaders in Alabama are ‘shaking off the pandemic,’” said Susannah Robichaux, a socioeconomic analyst for the center. “When there is a higher ABCI, it signals that business leaders are feeling optimistic about the coming quarter, which is absolutely informing their own decisions about their businesses.”

Business leaders expect to see an increase in sales, profits, hiring and expenditures in the second quarter, according to the survey.

Firms of all sizes reported especially strong confidence in growth compared to last quarter, though small firms with fewer than 20 employees had the most confidence.

In a telling sign from the survey, business leaders feel strongly they will increase hiring in the second quarter compared to the first. Only 6.5% of respondents expected to decrease hiring, and the healthcare and social assistance industry is the only one of nine industry categories that expects to possibly decrease in hiring, hinting at expectations of a possible contraction after a year of industry expansion.

Overall, business leaders are more confident in the state economy than the national outlook, but confidence in both increased from the first quarter of 2021.

The breakdown of all the industry forecasts by sector can be seen in the statewide ABCI report on CBER’s website.

In addition to the statewide ABCI report, CBER also collects ABCI data to write individual reports for Alabama’s five major metro areas. These metro reports offer insight into the forecasts for each specific region.