Q2 2023 Business Confidence Remains Negative

- April 18th, 2023

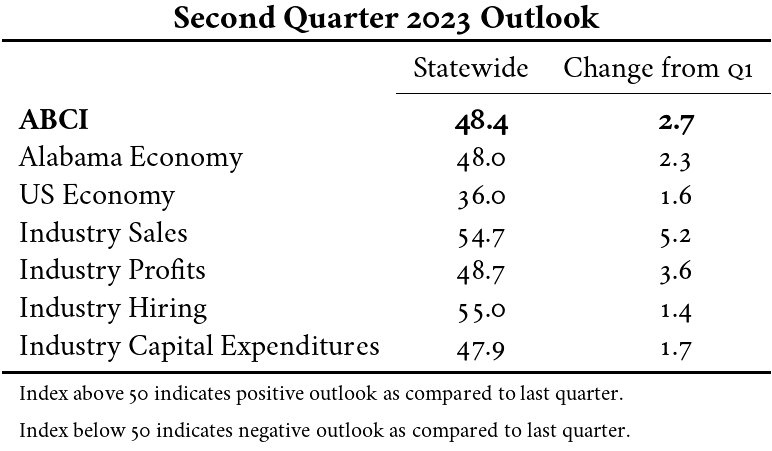

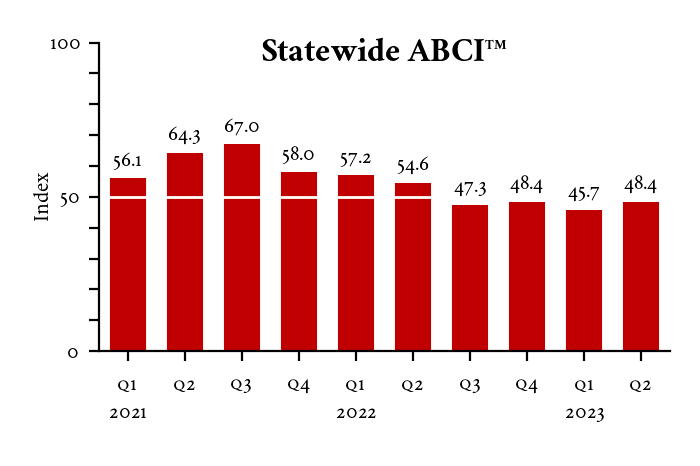

Business leaders throughout Alabama still have an overall mildly negative forecast for Q2 2023, according to the latest Alabama Business Confidence Index (ABCI) survey. This is the fourth consecutive quarter that the index has been negative, though it is slightly less negative than last quarter’s ABCI. Business confidence has been declining since Q4 2021, but interestingly, the highest and lowest component indexes have been consistent these last seven quarters: hiring has been the highest index and is the only index to remain positive the entire time, and the US outlook has been the lowest index, consistently registering more than 10 points below the other indexes.

On the ABCI website, you can view the detailed ABCI metro reports for Birmingham-Hoover, Huntsville, Mobile, Montgomery, and Tuscaloosa; the full statewide report that includes an overview for Alabama and the ABCI broken down by industry and firm size; and access historical data. Read on for an overview.

CBER’s forecasters are anticipating very mild growth in 2023, with a 0.5-percent increase in Alabama GDP for 2023. Though positive, it is a slower rate of GDP growth than seen in 2021 (5.1 percent) and 2022 (1.6 percent). Alabama employment growth is expected to plateau in 2023, only growing by about 0.3 percent. Total tax receipts are forecast to grow by 5.3 percent in FY2023. While this is more growth than predicted for GDP and employment, it is still a notable decrease from last year’s 15.2-percent.

The forecasts from the metro areas ranged from moderately negative to mildly positive in the Q2 2023 survey. Business leaders in Huntsville had the highest ABCI at 52.0, making them the only metro with a positive outlook for the quarter. Mobile was not far behind, though, with a neutral ABCI of 49.6. Tuscaloosa had mild confidence in their negative forecast (45.7), which was tempered by mildly positive forecasts for industry sales and hiring. Montgomery and Birmingham–Hoover had the lowest ABCIs for the quarter at 43.8 and 43.0, respectively, with all of their component indexes registering at or below the neutral 50.

The industry index, which only includes panelists’ forecasts for their own industry sales, profits, hiring, and capital expenditures, ranged from mildly negative to moderately positive in the Q2 2023 survey. In Q2 2023, panelists in professional, scientific, and technical services and construction are continuing to forecast growth with mild confidence, but they are also joined by “All Other Services” and manufacturing, whose indexes grew significantly from Q1 2023 to reach moderately high levels of confidence in their positive outlook.

Though it remained negative, the index for retail trade had the highest increase from last quarter growing 9.4 points from its very negative Q1 2023 index to reach a moderately negative 43.8. Expectations for hiring in retail are positive, but business leaders in the industry are forecasting decreased capital spending with very strong confidence in Q2 2023. The outlook from business leaders in finance, insurance, and real estate was the lowest industry index for the quarter at a moderately negative 42.6. This was the only industry category to have negative forecasts for all of the component indexes.

Though the ABCIs by firm size all remained below 50, there were varied levels of confidence in the forecasts for the component indexes. Midsize firms, those with 20 to 99 employees, had the highest Q2 2023 ABCI which increased 6.8 points to reach an almost neutral 49.5 for the quarter. This comes after three quarters of the midsize ABCI being the lowest industry firm ABCI. Small firms, those with up to 19 employees, had a mildly negative ABCI of 48.8 for the quarter. Large firms had the lowest ABCI of the three groupings at a mildly negative 46.7, which is only 0.1 points above the Q1 2023 large firm ABCI, indicating a continuation of last quarter’s forecasts.

This makes 86 consecutive quarters that the Center for Business and Economic Research in UA’s Culverhouse College of Business has measured sentiment about the economy and industry prospects in the state. If you are a business leader in the state, be sure to do your part by registering to be an ABCI panelist and contributing to this unique forecasting tool in the Q3 2023 survey from June 1-17.

You can view past and current reports by clicking on the buttons above or following this link: https://cber.culverhouse.ua.edu/alabama-business-confidence-index/.